|

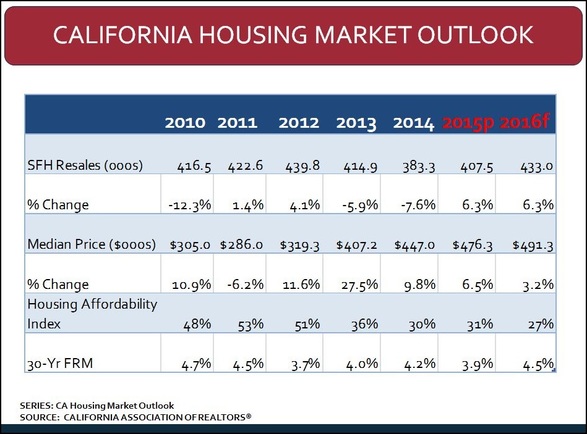

The following is great projection of the housing market for 2016. The article was mostly extracted from the California Association of Realtors blog. The market will continue the pace of 2015 and maybe more. “Home sales activities in California remained solid in September, but the growth in sales has moderated since it peaked in July. In fact, the annual increase of 6.9 percent was the lowest since February 2015. The statewide median price also continued to improve at a moderate pace, with a year-over-year growth rate of 4.3 percent in September. The mild growth rate in price was attributed partly to the shift in the mix of sales, as sales activities in lower-priced regions such as the Central Valley improved more significantly than the higher-priced San Francisco Bay Area in recent months. According to California Association of REALTORS® (C.A.R.), sales of existing detached homes will increase 6.3 percent in 2016 to 433,000, and the statewide median price will rise with an annual growth rate of 3.2 percent in 2016. Despite the anticipated improvement in the housing market condition in the upcoming year, there are some challenges and uncertainties that the economy and the housing market will face in 2016. One such unknown risk is the timing and the magnitude of the federal funds rate increase. The Federal Reserve has an opportunity to raise the rate in December before the end of 2015, but given the pace of the current economic growth, it is very likely that the Fed will begin the rate hike in early next year instead. The increase in the rate is expected to be mild and gradual throughout the next two years. Robust job growth in high-cost areas is another downside risk to the housing market. Due to the spillover effect of growth in high paying jobs, plenty of lower-paying jobs have been created, with many of these jobs being in the same geographic areas where the high paying jobs are being added. As such, income disparity in these areas could further complicate and deteriorate the housing affordability issue. Global economic issues could also begin taking a toll on economic growth later this year and next year. Slow growth in China and other European countries, coupled with stronger growth in the US, have paved the way for higher interest rates and lead to a stronger dollar. As such, international trade will likely be a drag on growth, as slower global growth and the stronger dollar soften the demand for exports, while continued strong growth in consumer spending domestically pulls in even more imports. Other potential risks that could have a negative impact on the California economy include the ongoing severe water shortage and the expected return of El Nino. Both could cause some economic losses, especially in the agricultural sector. However, the overall economic impact to the state of either risk is likely going to be small and may lead to minimal reduction in the employment growth rate for the next couple years.”

Areas like Orange County will keep attracting international funds and home prices will improve even more. Sadly, affordability will be harder to chase.

0 Comments

|

RSS Feed

RSS Feed