The Future of California Real Estate: Can the Golden State Survive?By Clare Trapasso | Sep 3, 20209/4/2020 Realtor.com published: California has long captured the nation's imagination with its promises of the rich life, from the days of the gold rush to the rise of Hollywood and its star-making machine, to today's booming tech sector. With its breathtaking shoreline and strong economy, the state has become indelibly known as a place abounding in opportunities—for those eager to seize them.

Lately, however, California's luster seems to be dimming. A severe housing shortage, exacerbated by the coronavirus pandemic, had led to the most expensive home prices in the nation. Wildfires this summer have devastated the northern part of the state. In the midst of a deep recession, many Californians are being priced out of their communities. Others are questioning why they're shelling out so much money each month to live there—especially with companies in places like Silicon Valley allowing employees to work from home, wherever in the world that home may be. It's all converging at once to test the state's true appeal. Despite the odds, can the Golden State's real estate market remain, well, golden? "Nobody in their right mind would bet against California," says real estate professor Christopher Leinberger of George Washington University, in Washington, DC. However, "the Golden State can't be golden forever with the ridiculousness of the home prices." California's home list prices reached a record high in August—and have experienced the second-loftiest increases in the nation, according to the latest data from realtor.com®. (Only Utah saw bigger price gains.) Nine of the 10 most expensive metropolitan areas in the nation are in the state. (We included only the 300 largest metros, which encompass the main city and surrounding suburbs, towns, and smaller urban areas.) The state's median price tag was $720,050 in August—up a jaw-dropping 23.7% from a year earlier. That's more than 10 times California's median household income of $70,489 in 2018, according to the latest U.S. Census Bureau data. The price hikes are due to the dearth of homes for sale. The shortage has been going on for years, but it's been compounded by the COVID-19 crisis. Shut in their abodes for months on end, Americans are seeking larger homes for working and schooling their children. But there simply aren't enough properties to satisfy demand, with the number of new listings down nearly 11.1% from August of last year on realtor.com. Leslie Appleton Young, chief economist of the California Association of Realtors®, attributes some of that rapid run-up in prices to rich, white-collar workers who can now telecommute buying up luxury properties in more remote locations. In July, sales of homes priced at $3 million and up increased by about 76.6% year over year, she says. Homes priced at $1 million and up now make up about 20% of the state's sales. "The challenge is, you have the next generation of home buyers, [but] it's very difficult to buy in California," she says. "We're losing people who simply can't afford to be here." Many Californians were already being priced outThe lack of affordable housing is partly responsible for the nearly 3.25 million Californians who left the state from 2014 through 2018, according to the latest U.S. Census data. It's also led giant tech companies like Google and Facebook, whose well-paid employees are partly responsible for the acceleration of prices in the San Francisco Bay Area, to pledge to build affordable housing in the area. Looking at migration patterns in the U.S., "people have been leaving California and the Bay Area in higher numbers than they have been arriving," says Patrick Carlisle, chief market analyst in the Bay Area for real estate brokerage Compass. "That outflow was being balanced by foreign immigration for years." More recently, however, that inflow of foreigners has declined. Before the pandemic, Gov. Gavin Newsom boasted California had the fifth-largest economy—in the world. But COVID-19 has dealt the state's economy a blow. California had a 13.3% unemployment rate in July, the sixth-worst in the nation, according to the U.S. Bureau of Labor Statistics. “The housing supply in California is the No. 1 priority," says Dowell Myers, a housing demographer at the University of Southern California, in Los Angeles. If the situation doesn't improve, the lack of housing "will stifle employment growth and undercut the economy," he says. The quality of life could deteriorate enough to spur more folks to leave and deter others from moving in, he says. Wealthier tech workers can still afford to drop nearly $1.2 million on a median-priced home in Silicon Valley's San Jose metropolitan area, according to realtor.com's August list prices. But many others realize they can pay a fraction of that to live in other hip cities with growing tech hubs, like Austin, TX, with a median list price of roughly $400,000; Salt Lake City, at $490,000; and Nashville, TN, at $396,000. Even other West Coast tech hubs like Seattle and Denver are significantly cheaper, with median prices of $625,000 and almost $540,000, respectively. Departing residents are "much more of a threat than a fire or an earthquake” to the state, says Myers. Although it attracts well-educated, high-earning millennials from other states as well as foreigners, California might see these higher-earning transplants leaving after a few years. "They feel like they can't possibly live where they want to live and buy a house," says Myers. "California could hold more of the recruits if it had cheaper housing." George Washington University's Leinberger blames NIMBY ("not in my backyard") attitudes, which have stymied the creation of new housing throughout the state. While many residents support new construction, they don't want it in their own communities. They worry that creating more dense housing, such as apartment, condo, and townhome complexes as well as smaller homes, could lower their own property values. They also say it would tax the existing infrastructure, like schools and local services, and exacerbate traffic issues. Even well-meaning local regulations can drive up building costs and lead to long delays that can stretch over a decade between an application being submitted and a shovel going into the dirt. “This is a self-inflicted wound," says Leinberger of the housing shortage. Could the pandemic prompt more people to leave California?Although there has been a steady stream of Californians leaving their home state for years, the pandemic could accelerate that trend. With more white-collar workers able to work remotely, some are heeding the siren song of more affordable homes, lower taxes, and a cheaper cost of living outside California's borders. Others are remaining in state, but forsaking the expensive cities and moving into less-expensive areas. “In the short term, California is going to see more people leaving due to the high cost of living combined with the ability to work remotely," predicts realtor.com Senior Economist George Ratiu. "People are willing to pay a premium to live there," says Ratiu. "Perhaps that premium is being reevaluated by a lot of younger people.” California could see winning and losing real estate marketsWhile some of California's housing markets may be forced to slow down, others will likely keep accelerating. "California's a big place. You're going to have winners and losers within the state," says Mark Zandi, chief economist of Moody's Analytics. "The housing markets in those urban cores are struggling. That will continue throughout the pandemic." In the Bay Area, sales for single-family homes in San Francisco and larger residences in the more suburban counties have been brisk while condo sales within the city limits have dropped off as a result of the pandemic, says Bay Area analyst Carlisle. That's driven by wealthy, white-collar workers who are able to work remotely. In addition to the surge in interest in expensive, sprawling homes north of San Francisco, in Marin County and Napa and Sonoma, buyers with means are trading their rentals and smaller homes in high-priced, urban areas for larger homes in more affordable, inland communities in California. Some are leaving the state altogether for hip cities with strong job markets. However, many more are staying put. Southern California, including Los Angeles and San Diego, could fare better than Northern California's Bay Area as it's a little less expensive, says Matthew Gardner, chief economist of Windermere Real Estate. Residents who work in the entertainment and other Southern California industries may be less able to work from home as the Bay Area tech workers. "We're not talking about cities being abandoned," says Carlisle. "Shifts in markets are shifts in degrees. Except for something like the housing bust of 2008, [markets] slow down.” And no matter what trials it's currently going through, California is still, well, California. "It's hard to envision a large exodus," says Appleton Young. "We are [still] the tech hub, we're the entertainment hub, we're rich in natural resources and natural beauty." California was home to five of the nation's 30 worst-performing markets in the second quarter.

The TrendThis pricing report, which tracks the median selling price of existing single-family homes in 178 markets, shows a broad trend of cooling appreciation. This price chill is a tad more extreme in the Golden State. Let’s start with the nationwide picture. U.S. prices in the second quarter were up 4.3% vs. a year earlier to $279,600, with 16 markets posting declines. That’s a slight appreciation dip from averaging 5.5% annual gains in 2016-2018, a period when just eight U.S. markets were losers. Next ponder California, especially near the coast. In Silicon Valley, prices took the nation’s second-biggest loss in the quarter: a 5.3% year-over-year decline. That’s quite the contrast from 2016-2018, when the San Jose-Santa Clara market’s prices averaged 15.7% annual gains — the No. 1 gain nationally. Still, this market’s median of $1.33 million for the quarter was the U.S. high. Just to the north, San Francisco suffered the seventh-biggest U.S. decline of 1.9% in the year. Again, quite the flip-flop: In 2016-2018, San Francisco prices averaged 9.6% annual increases — the No. 19 gain. Its second-quarter median of $1.05 million was second highest. Three other coastal California markets had thinning gains that graded poorly on the national scorecard. Orange County: 19th weakest with 0.6% gain. In 2016-2018, prices rose at a 5.8% annual pace — the No. 85 gain nationally. Median of $835,000 was third-highest nationally. San Diego: 27th weakest with a 1.6% increase. In 2016-2018, prices averaged 6.7% annual gains — No. 69 nationally. Median of $655,000 was fifth-highest. Los Angeles: 30th weakest with a 1.8% increase. In 2016-2018, prices rose 8% annually — the No. 38 gain. Median of $567,000 was seventh-highest. Not every California market looked as dicey. Inland markets, with more affordable options, fared better. In the Inland Empire, its above-average 5.6% second-quarter gain was a mid-range 78th largest. Still, it’s a dip from 2016-2018 when prices rose at an 8% yearly rate — the nation’s 37th highest. The median price in Riverside and San Bernardino counties of $380,000 ranked 22nd highest. And Sacramento’s gains ranked 128th in the quarter, up 2.9% vs. averaging 7.8% in 2016-2018 (45th highest). Sacramento’s median of $385,000 was 20th priciest nationally. Sign up for The Home Stretch newsletter and its new Bubble Watch edition. Get a twice-a-week serving of hot housing news from around the region! Subscribe here. The DissectionNo index is a perfect home value measurement, and the Realtors’ index of existing, single-family home sales covers an important but not comprehensive slice of the market. But looking at a broad spectrum of housing benchmarks, one thing’s clear: California’s big price gains are history. What’s up for debate is whether noteworthy depreciation is occurring in some geographic or markets niches. California home sellers losing their pricing power is no grand surprise considering the steep run-up of prices in recent years and a recent cooling of the state’s business growth pace. House hunters have choices, as more homes are listed for sale. And last year’s sharp-but-brief spike in mortgage rates certainly didn’t help prices as house hunters, at a minimum, lost buying power. Let’s be clear: This is by no means just a California issue or one involving the nation’s upper-crust markets. Look at the nation’s biggest loser, Bismarck, N.D., with a 5.5% decline that follows 2016-2018 losses averaging 0.7% yearly — fifth-worst nationally. Its median price? Just $248,800! Bismarck may have a lofty median household income for its size — $61,000, roughly the same as L.A. — but it’s suffering the loss of once-booming, good-paying energy jobs. And second-quarter depreciation, by Realtor math, was also found in markets in Illinois, New York, Wisconsin, Florida, Oklahoma, Hawaii, Colorado, Kansas and Connecticut. How bubbly?On a scale of zero bubbles (no bubble here) to five bubbles (five-alarm warning) … THREE-AND-A-HALF BUBBLES! First, let’s have a chat about what’s a bubble and when is it bursting. Bubbles are unsustainable economic advances. Falling prices alone do not indicate a bubble or its imminent bust. But depreciation is certainly a negative trend worth serious attention. And this may be a case of “be careful what you wish for.” You could dismiss these 2019 price dips as a predictable plateau after a long-running upswing. But painless plateaus are hard to accomplish. That’s because depreciation hurts economically … and emotionally. Lots of people talk about wanting more “affordable” housing in California, but the creation of relative bargains with price cuts on existing homes often scares off the same house hunters who claim they want to pay less. Why? These wannabe owners can get scared of overpaying as a price slide begins. Or they’ll wait to buy, hoping the discounts only get steeper. That wait-and-see mentality can amplify an already souring situation. Of course, today’s suddenly cheaper mortgage rates plus these price “markdowns” shown in the Realtor data could be a cure for California housing’s “affordability” challenges. From the OC Register. Luxury house flipping has increased in several markets throughout the U.S., according to data from realtor.com provided to Mansion Global. In 2018, 2.6% of homes valued at over $1 million were flipped, compared to 2.2% the previous year.

Realtor analyzed markets where there were at least 20 flips on homes that sold for more than $1 million, from January to October of 2018, defining a flip as a home that sold twice, for a profit, within a year. Although the data show that house flipping is rising, its frequency remains low relative to the years before the 2008 recession. Mansion Global is owned by Dow Jones. Both Dow Jones and Move.com are owned by News Corp. Real estate analysts say that house flipping in the early 2000s helped fuel the burst of the housing bubble, and as a result, banks today are exercising far more caution when determining who qualifies for large home loans. Today, house flipping is at a 10-year high across the country, but mostly for homes valued in the low millions. "The main trend we’re seeing is that the million-dollar mark is not what it used to be. If you look at the 2018 numbers, there’s a lot of activity happening at the entry level," Mr. Vivas said. "There’s still demand at that price point, which is causing activity to surge slightly. Markets seeing the largest frequency of house flipsThe number of investors flipping houses has declined over the past decade, but last year saw a modest increase in luxury home flipping, with 14 of the 15 markets that Realtor looked at showing a rise in the share of home sales that were flips. The California markets of Los Angeles, Long Beach, and Anaheim had the most substantial gains and topped the list for the second year in a row, with an increase in the percentage of luxury home flips from 3.4% in 2017 to 4% in 2018. Mr. Vivas attribute this to the region’s higher luxury inventory and fast-paced market. "It was one of the fastest-growing luxury markets last year overall, so it’s a function of sales being higher and growing at a healthy pace, which can result in flips growing at a healthy pace," he said. "The share of inventory above $1 million in Los Angeles is large, too, and above most other markets." There has also been a shift in L.A.’s culture that is drawing in new investors from around the globe, said Santiago Arana, a broker with The Agency in Los Angeles. "L.A. has finally become a worldwide, destination city where wealthy people want to invest in real estate," Mr. Arana said. "Tech companies are moving in, there’s been a gigantic investment in the new football stadium, George Lucas is opening a new museum, and there is incredible growth and development downtown." Of the markets analyzed, the area encompassing Miami, Fort Lauderdale and West Palm Beach was the only one to experience a slight decrease, dropping from 2.1% in 2017 to 1.7% in 2018. "There appears to be no correlation between the growth in sales and subsequent flipsin each respective market," said Jonathan Miller, chief executive of New York-based appraisal firm Miller Samuel. "In fact, sales in Miami rose sharply by 27.7%, and the share of flips declined. Sales in the NYC metro area declined 11.1%, yet the share of flipping rose." Florida’s reputation as a tax haven--the state is attracting buyers from areas like New York and New Jersey with high income and property taxes—may be behind the drop. A lot of demand shifted to Miami from high tax areas, so there was a slight uptick in demand outpacing supply," Mr. Vivas said. "It’s constricting the amount of inventory and how much can be flipped." Furthermore, he added, Miami’s stock of properties over $1 million is lower than that of cities like L.A., and many flips happen with homes under that threshold. The trend of lower-price homes being more frequently flipped may also ring true in the New York City area: an April 2018 report from the Center for NYC Neighborhoods found that house flipping was common in the city’s most affordable neighborhoods, and that 34% of homes flipped in 2017 were in foreclosure. According to Realtor’s data, only 150 properties above the $1 million mark in New York City were flipped in 2018, an increase of 0.6% from 96 homes in 2017. Predictions for 2019With a slowdown anticipated for luxury real estate markets in 2019, it’s possible that home flipping, too, could begin to taper off. Changes to the U.S. tax code enacted last year, in particular, could make investors reluctant to make any large purchases this year. "Buyers and sellers are adjusting their expectations,: Mr. Vivas said. "We’re already seeing a lot of that with price reductions, and increases in the amount and types of price cuts happening above the $1 million mark." The data on house flipping is limited, he added, so it’s important to weigh other indicators when considering a new investment. Overall, Mr. Arana said, he expects no big surprises in 2019. "People are talking about a big bubble, but I don’t think it will be like 2008—the fundamentals are too strong for that," he said. "We want an adjustment [from the faster pace of previous years.] That’s healthy." 5 reasons the millennial home-ownership rate is low

Source: Housing Wire Millennials waited, and continue to wait, longer than previous generations to own a home, and new data from the Urban Institute reveals why. The generation's homeownership rate was 37 percent in 2015, about 8 percentage points lower than the rate of Gen Xers and Baby Boomers when they were ages 25 to 34. MAKING SENSE OF THE STORY

Rate news summary

From Freddie Mac’s weekly survey: For the very first time in 2018, rates have dropped. The 30-year fixed averaged 4.44 percent, down 2 basis points from last week’s 4.46 percent. The 15-year fixed averaged 3.90 percent, 4 basis points lower than last week’s 3.94 percent. The Mortgage Bankers Association reported an almost 1 percent increase in loan application volume from the previous week. Bottom line: Assuming a borrower gets the average 30-year conforming fixed rate on a conforming $453,100 loan, last year’s rate of 4.30 percent and payment of $2,242 is $38 less than this week’s payment of $2,280. What I see: Locally, well-qualified borrowers can get the following fixed-rate mortgages at 1 point cost: 15 years at 3.50 percent, 30 years at 4.125 percent, a 15-year agency high balance ($453,101 to $679,650) at 3.75 percent, a 30-year agency high balance at 4.125 percent, a 15-year jumbo (over $679,650) is at 4.25 percent and a 30-year is at 4.375 percent. What I think: With all of the grumblings about low inventory levels and overpriced properties, home flippers are crushing it. Go figure. Nationally, 2017 data indicates home flipping sales volume jumped to an 11-year high, according to Irvine-based Attom Data Solutions. “California ranked as the 11th highest flipper state with 6.2 percent of all homes were flipped,” said Daren Blomquist, Attom’s senior vice president. “The second sale of the same property within a 12-month period defines a flip.” Fresno led California for the highest number of 2017 flips at 9.6 percent. In Southern California, the Riverside-San Bernardino metro area ranked sixth with a per property gross flip profit of 36 percent. That translates to an average of $79,300. Nice! The Los Angeles and Orange County market turned a 2017 gross profit of 32 percent, averaging a doubly-nice gross profit of $135,000. Cha-ching! Not to worry if you can’t pay cash. Financing is available for investors who want to keep the property or fix, then flip it. Fannie Mae has a loan named Homestyle that will provide investor-purchase financing and fix-up funds for one to four units. One interesting loan I came across for those wanting to “mansion-ize” a flipper allows you to put as little as 10 percent down, not to exceed 80 percent of the “as is” property value. For example, you purchase a property for $1 million but it’s worth $1.2 million before improvements. You can go in with $100,000. With a cherry on top, the investor will make available as much as 80 percent of the fix-up funds based on the completed value. Interest rates range from 8 percent to 11 percent and 2-4 four points. There are traditional construction loans available, but the challenge is all red tape to get an approved plan, contractor bids, etc., before the seller gets too impatient with a likely long escrow period. Now, if you are looking to buy a recently fixed-up property, caution ahead! Engage an experienced home inspector to dig deep. “Fifteen to 20 percent of flipped properties I inspect are not done in a workman-like manner,” said Jon Wilhelm of Studio City-based Valley Home Inspection Service. The biggest problems Wilhelm sees are shoddy structural modifications like opening up walls, electrical violations and moving roof framing without permits. Wilhelm estimates 20 percent of the first contracted buyers to have inspections done on recently flipped properties walk away because problems are found and the seller is unwilling to fix them. It’s usually the second buyer contract that sticks because the seller now has something on record that can cause liability if undisclosed and or unrepaired. A property inspection can cost anywhere from $300 to $800. According to the LA Times, home prices in California will continue to increase next year, but at a slower pace, said a forecast released Thursday by the California Association of Realtors.

The median price of a home is expected to rise 4.2 percent in 2018 to $561,000, less than the expected 7.2 percent increase this year. While the forecast from the Realtor group did not include specific San Diego County estimates, researchers said the figures should be similar to the state total because Southern California represents the state’s biggest housing market. Leslie Appleton-Young, chief economist for the organization, said a lack of homes for sale — because of construction not keeping pace and other factors — would keep home prices rising for the next three to five years. But, she said affordability constraints stop the increases from rising higher because of the gap between income increases and home prices. “The slower income growth is really hampering the ability of first-time buyers to get into the market,” Appleton-Young said in a presentation at the Marriott Marquis San Diego Marina as part of the annual CAR Expo. She predicted statewide affordability would drop to 26 percent, down from 51 percent in 2012 when the recession was still having a significant effect. The association measures affordability by checking if the monthly housing payment does not exceed 30 percent of gross monthly income. Appleton-Young said sales of homes have stayed at about the same level for years — which doesn’t make a ton of sense if you consider substantial job growth and historically low mortgage interest rates. But, fewer homes and increasing prices have stopped sales from picking up. Sales are predicted to increase by 1 percent in 2018, down from the expected 1.3 percent increase this year, she said. In the next few years, California’s population will grow — up to an estimated 40 million people in 2018 from 39.4 million in 2016 — and so the need for more housing will increase, too. But, that doesn’t mean the state isn’t losing some important people. “You’re seeing an exodus of younger people from California,” she said. “Because they can’t afford to buy. It’s starting to hamper the ability of tech companies leading the charge with job growth.” International buyers are expected to continue to be interested in California in the coming years, officials at the Realtor organization said, because prices here are still cheaper compared to other places around the world. Although, there will likely continue to be a reduction in Chinese buyers as that nation’s government cracks down on how much money leaves the mainland. Another prediction for next year is that less expensive areas will see increased demand from many buyers who are priced out of other in-demand locations. Expo attendee Jan Ryan, an Re/Max agent based in Ramona, said she has already seen an increase of people from central San Diego who are searching for cheaper housing in the rural area where she has been based for 34 years. She said for most of her career she has worked with a lot of family members of people who lived in the area. But, nowadays, people are seeking out properties farther east because they can’t afford anything closer to the coast, even though they might work out there. “You get a lot more for your money,” she said. “We’re a small town with good schools, less traffic, a lot of community events and a lot of room for growth.” Lack of homes for sale in California was a major topic of discussion at the Realtor exposition, with blame being thrown at multiple sides. At a session on Wednesday, Alan Ratner, housing research analyst at Zelman & Associations, said regulations were harming builders’ ability to get more homes constructed. “Right out of the gate, a builder is in the hole on average about $50,000 before they even start building a place,” he said. Lynn Reaser, economist at Point Loma Nazarene University, said a major factor in San Diego County has been community opposition to new projects. She gave the example of a builder in the region that has been trying to build housing around transit areas — something promoted by the state — but keeps running into opposition. Issi Romem, chief economist of BuildZoom, said part of the problem is a lack of construction workers to build all the housing that analysts say California needs. “The construction industries have a hard time drawing in younger workers,” he said. “They lost many of its members in the last down cycle and it hasn’t regained those.” Los Angeles is in a sweet spot in its real estate cycle that will make it one of the top choices in the world for buying property this year, a new report says.

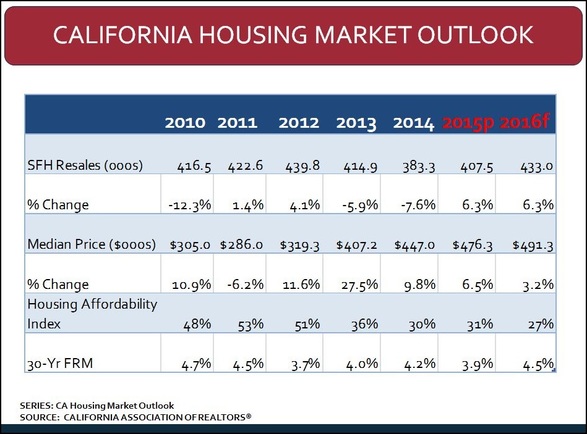

The L.A. area ranked No. 1 in North America in a survey of global real estate investors who have a combined total of $1.7 trillion to spend on property in 2017. Top choice cities for investment in other regions were London and Sydney, Australia. Overall, offices are the preferred category of real estate to buy, with warehouse distribution centers and multifamily residential buildings close behind. Shopping centers, hotels and industrial properties ranked lower in investor interest. “L.A. has been waiting for this moment for a long time,” said Lew Horne, president of Southern California and Hawaii for CBRE Group Inc., the Los Angeles-based international real estate services company that conducted the survey to be released this week. Among the participants were investment fund managers, insurance companies and operators of pension and sovereign wealth funds. It was the second year in a row that Los Angeles was the top choice for investment in the Americas. In the first CBRE Global Investor Intentions Survey, conducted two years ago, San Francisco ranked No. 1 in the region. Forty percent of investors said they intend to spend more this year than this did last year, while 16% said they would spend less. Researchers caution that while the outlook for commercial real estate investment looks more positive this year than it in 2016, we are now the eighth year of a global economic expansion. Property values have risen for the most part every year since 2009, which suggests the market may be peaking. Only 15% of respondents, however, said that property is overpriced and that bubble conditions exist. Of greater concern was the fear that interest rates could rise faster than expected (21%) or that an undefined “global economic shock” could undermine demand from renters (22%). Los Angeles is in a more favorable point in its real estate cycle than other markets are in theirs, said Todd Tydlaska, a CBRE broker who specializes in investment property sales. “Rents in other markets have really run up” in recent years, he said. “L.A. was late to the recovery and still has room for rents to rise.” Property prices in Los Angeles are also considered a bit of a bargain by international standards, Tydlaska said. “L.A. is still a value compared to San Francisco.” Even though investors remain bullish on Los Angeles, it may be hard to top the volume of money spent there last year, he said, when some enormous deals took place. Among the biggest were the $1.34-billion purchase of four Westwood office buildings by local real estate investment trust Douglas Emmett Inc. and the Qatar Investment Authority, as well as the $511-million purchase of the Colorado Center office complex in Santa Monica by Boston real estate investment trust Boston Properties Inc. Another was the $429-million purchase of two Playa Vista office buildings by New York landlord Edward J. Minskoff Equities Inc. All three were among the 50 largest office deals in the country last year, according to real estate software provider Yardi Systems Inc. “Los Angeles’s office market reigns supreme as the main target for investment on the West Coast,” Yardi said in a report. The Westside, where those those and other big sales took place, is the L.A. area’s core market for investment, according to CBRE, in part because it consistently commands the highest rents in the region. But downtown Los Angeles, which has seen billions of dollars worth of investment from Chinese and Canadian firms in recent years, is also growing in appeal to U.S. developers with experience in other cities where old neighborhoods have already been transformed, Horne said. He expects still more investment in once-neglected blocks such as L.A.’s Arts District and Historic Core. “The guys from New York and San Francisco have already seen this movie before,” Horne said.  "Fashion Island is returning to its classic tree lighting tradition with the annual ceremony on November 18 & 19 from 6pm – 6:30pm in the Neiman Marcus – Bloomingdale’s Courtyard. Hosted by KOST 103.5 FM’s Mark Wallengren, enjoy a 25-minute live musical performance of The Magic of Christmas starring The Young Americans. See Santa and Mrs. Claus bring the tree to life as we celebrate this special time of year. And, of course, there will be “snowfall”! Then, after the show and the tree is aglow, come visit Santa…Ho! Ho! Ho! *Blankets and low chairs will be permitted on the lawn areas on either side of the stage only. Once these areas are full, there will only be standing room available. Spots can be saved by placing blankets on a first-come, first-served basis during the day of the event. There will be a reserved seating section in compliance with ADA requirements." Courtesy of visitnewportbeach.com The following is great projection of the housing market for 2016. The article was mostly extracted from the California Association of Realtors blog. The market will continue the pace of 2015 and maybe more. “Home sales activities in California remained solid in September, but the growth in sales has moderated since it peaked in July. In fact, the annual increase of 6.9 percent was the lowest since February 2015. The statewide median price also continued to improve at a moderate pace, with a year-over-year growth rate of 4.3 percent in September. The mild growth rate in price was attributed partly to the shift in the mix of sales, as sales activities in lower-priced regions such as the Central Valley improved more significantly than the higher-priced San Francisco Bay Area in recent months. According to California Association of REALTORS® (C.A.R.), sales of existing detached homes will increase 6.3 percent in 2016 to 433,000, and the statewide median price will rise with an annual growth rate of 3.2 percent in 2016. Despite the anticipated improvement in the housing market condition in the upcoming year, there are some challenges and uncertainties that the economy and the housing market will face in 2016. One such unknown risk is the timing and the magnitude of the federal funds rate increase. The Federal Reserve has an opportunity to raise the rate in December before the end of 2015, but given the pace of the current economic growth, it is very likely that the Fed will begin the rate hike in early next year instead. The increase in the rate is expected to be mild and gradual throughout the next two years. Robust job growth in high-cost areas is another downside risk to the housing market. Due to the spillover effect of growth in high paying jobs, plenty of lower-paying jobs have been created, with many of these jobs being in the same geographic areas where the high paying jobs are being added. As such, income disparity in these areas could further complicate and deteriorate the housing affordability issue. Global economic issues could also begin taking a toll on economic growth later this year and next year. Slow growth in China and other European countries, coupled with stronger growth in the US, have paved the way for higher interest rates and lead to a stronger dollar. As such, international trade will likely be a drag on growth, as slower global growth and the stronger dollar soften the demand for exports, while continued strong growth in consumer spending domestically pulls in even more imports. Other potential risks that could have a negative impact on the California economy include the ongoing severe water shortage and the expected return of El Nino. Both could cause some economic losses, especially in the agricultural sector. However, the overall economic impact to the state of either risk is likely going to be small and may lead to minimal reduction in the employment growth rate for the next couple years.”

Areas like Orange County will keep attracting international funds and home prices will improve even more. Sadly, affordability will be harder to chase. |

RSS Feed

RSS Feed